Purposes and concerns

Since the seventies, Complex and chaotic nonlinear dynamics (in short, Complex Dynamics) constitute a growing and increasingly important area that comprises advanced research activities and strongly interdisciplinary approaches. This area is of a fundamental interest in many disciplines, including Economics, Statistics and of course Mathematics, Physics, Biophysics, Signal Processing, etc.

The aim of this publication¹ is to try to offer a stimulating environment for the study of Complex Dynamics. The assigned objective can only be approached by an opening to the other disciplines related to the subject. In addition, bring together theoretical exploration and investigation empirical instruments appears to be a necessity to present this vast area.

Let us start with a comment about the interest of Complex Dynamics in Economics and in so doing the necessity of such a publication¹ and its interdisciplinarity: Mathematics in Economics have a very strong didactic role.

Mathematics state theoretical models and paradigms that must conform to measurements. However, in Economics the measurements are rare, more often of a small number of points and of a very low density, except for stock markets. This chasm that separates Economics from the “dense” measurable reality has maintained economists in a kind of “isolation” (compared with other sciences): 1. that of the qualitative approach that can be conducted, for instance, in a literary way, very often of great relevance but which is not quantitative, 2. and that of the construction of models (“mathematical idealities”) with a strong didactic or mechanistic vocation often far from the richness of “the living”. This is above all a problem of measurement.

Mathematics state theoretical models and paradigms that must conform to measurements. However, in Economics the measurements are rare, more often of a small number of points and of a very low density, except for stock markets. This chasm that separates Economics from the “dense” measurable reality has maintained economists in a kind of “isolation” (compared with other sciences): 1. that of the qualitative approach that can be conducted, for instance, in a literary way, very often of great relevance but which is not quantitative, 2. and that of the construction of models (“mathematical idealities”) with a strong didactic or mechanistic vocation often far from the richness of “the living”. This is above all a problem of measurement.

Beyond the change of paradigm or the epistemological revolution of nonlinear theory, today there is that of the information systems and networks, which will provide the exceptional opportunity to capture dense measurements in numerous fields of Economics (e.g. from consumer behaviors up to national accounts, etc).The economists will be or are already in an opposite situation than before. The measure flows will have densities increasingly similar to those of other sciences whose measures come from “the living” for example. Economics will have to treat these measure flows with relevant tools, which are necessary to master. This is a turning point for Economics.

Thus, Mathematics and its analytic tools are more relevant than ever for economists, in particular to study Complex Dynamics and to bring closer theoretical models and information coming from signal or time series measurements. Calculation capabilities, networks, measurements and information treatment also make the existence of such a publication¹ legitimate and necessary.

More than in the past, Economics calls for nonlinear formalizations that provide complex formal solutions. Economics does not escape this revolution.

Thus, Mathematics and its analytic tools are more relevant than ever for economists, in particular to study Complex Dynamics and to bring closer theoretical models and information coming from signal or time series measurements. Calculation capabilities, networks, measurements and information treatment also make the existence of such a publication¹ legitimate and necessary.

More than in the past, Economics calls for nonlinear formalizations that provide complex formal solutions. Economics does not escape this revolution.

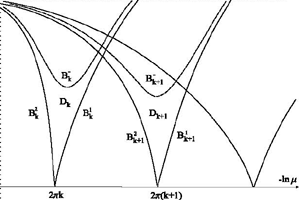

It is around this concept of nonlinearity adapted to the formalization of natural phenomena and around chaotic dynamics that this whole publication is organized. They constitute the vital leads of its four Parts that respectively concern:

- Part I. Mathematics in the nonlinear field,

- Part II. Evolution of Statistics to the nonlinear field,

- Part III. Contribution of Signal Processing to the nonlinear field,

- Part IV. Evolution of Economic Growth Models to the nonlinear field.

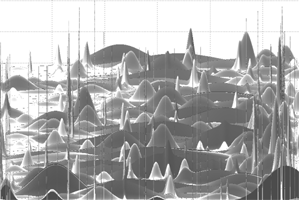

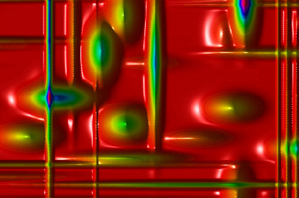

The recent contributions of signal theory in relation with nonlinear dynamics are powerful means of analysis and have an important potential. In this regard, the third Part covers signal theory in a didactic way (Fourier, Wiener, Gabor, etc.) but also by presenting advanced contents (polyspectra already used by economists, best basis, multiresolution analysis, hybrid waveform dictionaries, matching pursuit algorithms with time-frequency atoms, etc.). The applications concern, for instance, stock indexes, standard signals, signals of coupled oscillators or turbulent phenomena highlighting coherent structures. Signal theory certainly has to be promoted in Economics; this publication¹ contributes to this aim also.